Posted by Tina

Posted by Tina

Twenty five years ago the state of Connecticut decided the implementation of a state income tax would solve it’s budget and debt woes. The state’s citizen’s assumed that legislators would use the money taken from their paychecks to put their state on a fiscally responsible path. Funny how people keep putting their faith in government. Funny how easy it is for those running for office to persuade the people that additional sacrifice from them will result in improvement. Over those twenty five years conditions have not improved, in fact, they have gotten worse. People are slow learners. In the past few years the solution shifted to a tax-the-rich scheme. It failed.

This year both Standard and Poors and Fitch downgraded the state’s credit rating. Their level of debt and deficit spending makes the state a poor credit risk. Like most high tax states Connecticut has experienced outward migration in part as a result of their high tax policy. A study by The Yankee Institute for Public Policy found that outward migration “causes the state to lose $60 of income every single second.” Their analysis is confirmed by taxpayer data from the IRS:

Between 1992 and 2014 (the most recent year for which Internal Revenue Service taxpayer data is available), Connecticut lost $12.36 billion in net adjusted gross income (AGI). Perhaps not surprisingly, the bulk of this outwardly migrating AGI went to states that do not punish work by levying an income tax. The state of Florida won the lion’s share of Connecticut’s fleeing AGI, with $7.96 billion leaving the Nutmeg State for the Sunshine State.

Bending to progressive-think, Connecticut elected to solve their fiscal problems by targeting the rich, raising their tax burden twice in the last six years. The resulting revenue shortfall is causing a severe migrain for legislators…doesn’t it always? Here are the numbers:

HARTFORD, Conn. (WTNH)-Connecticut’s state budget woes are compounding with collections from the state income tax collapsing, despite two high-end tax hikes in the past six years.

It means the current budget year, which ends in just two months, is now seriously in the red and next year’s deficit has ballooned to $2.2 billion.

It’s happening because the state of Connecticut depends too much on its wealthy residents, and wealthy residents are leaving, and the ones that are staying are making less, or are not taking their profits from the stock market until they see what happens in Washington.

The rich are waiting to see if their federal tax bill will offer them some relief from the onerous burden federal and state legislatures keep piling on their shoulders. At the federal level, a 2014 report from the Tax foundation found that the top 1% pays more in taxes than the bottom 90%! Not only that but the numbers of people that are not asked to contribute a single dime has increased dramatically since the 1980’s:

In 1980, the bottom 90 percent of taxpayers paid 50.72 percent of income taxes. In 2011 (the most recent year the data is available), the bottom 90 percent paid 31.74 percent of taxes. On the flip side, the top 1 percent paid 19.05 percent of taxes in 1980 and now pay 35.06 percent of taxes.

An interesting piece of information from the chart below is that after the 01/03 Bush tax cuts, often claimed to be a tax cut for the rich, the tax burden of the top 1 percent actually increased significantly.

One reason for the decline in the bottom 90 percent’s tax share is likely the proliferation of tax credits. In the last 30 years, the number of tax credits has increased, specifically refundable tax credits. The combined cost of refundable and standard tax credits has gone from around $20 billion in 1990 to $176 billion in 2010, with refundable credits accounting for about $100 billion of that growth.

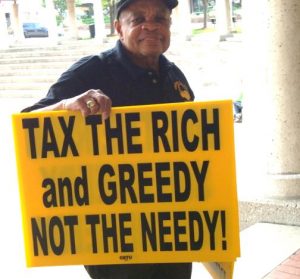

The lie extends to the progressive left incantation, “tax the greedy not the needy,” a spell under which too many citizens fall. The Daily Caller reported in 2015 that 45%, close to half, of American workers pay zero in income taxes. ZERO! Most of them not only pay nothing, they also receive supplemental income and/or benefits from our government. The needy are not taxed under the income tax code! Hell-lo!

At some point these lefty lies have to be exposed and rejected as absurd! At some point we have to realize taxing the rich costs all of us in terms of economic opportunity. At some point the population has to admit that asking the rich to “pay their fair share” is fine when it IS fair. But when it begins to exceed half of what they earn that becomes a terrible embarrassing insult…it becomes a situation where a reckless needy-greedy mob becomes a thieving band of criminal miscreants making a run on the earned property of the rich…and that is NOT an American value.

Taxing the rich, especially when they are taxed at disgustingly high rates, does not work to bring in revenue. It does just the opposite. Revenues drop dramatically. When that happens the economy becomes sluggish and job opportunities die. Additionally, taxing the rich does not in any way constrain the spending habits of legislators or inspire them to stay within their budgets. Nothing seems to hold legislators to their fiduciary responsibilities as the managers of the people’s money.

Taxing the rich, especially when they are taxed at disgustingly high rates, does not work to bring in revenue. It does just the opposite. Revenues drop dramatically. When that happens the economy becomes sluggish and job opportunities die. Additionally, taxing the rich does not in any way constrain the spending habits of legislators or inspire them to stay within their budgets. Nothing seems to hold legislators to their fiduciary responsibilities as the managers of the people’s money.

Dyed-in-the-wool socialists are lost souls who find virtue in oppression, tyranny, and dependency in the citizenry. I expect nothing from them. As we see by their behaviors mob rule, deception, destruction, and thievery are acceptable tools in their politics of greater government control and irresponsible government.

I feel like a harpy pounding on this issue again and again. Sad, but I feel I must. It’s indeed sad that America has we come to this place of wide scale irresponsible…nay, deceptive and irresponsible governance at both state and federal levels! Harping may be the only effective way to reach the uninformed and the duped in today’s ill informed and poorly educated populace. That is exactly why we see mobs in the streets today bearing such signage as depicted in this article. Young people in particular have no experience and are highly susceptible to the fallacies involved in the leftist tax-the-rich scam.

I still believe that most people, when given the facts, make the correct decisions. The future of our young, which is the future of America, depends on their sound understanding of capitalism, taxation, and good money management. I will continue to harp as long as I have the platform.

Related: See how other high tax states are affected by high tax rates (interactive map) at How Money Walks which concludes, “…the key to accumulating working wealth for any state is a pro-growth tax policy, and that means not taxing personal income.”

I highly recommend the series “The Men Who Built America”. It should be shown in every high school class room. Here is a link to the final episode, number 8.

https://www.youtube.com/watch?v=QlTX6i_FMQo

Watch all 8, but for the moment, go to the 28:00 mark and let it play as the narrator explains America’s greatest innovation yet, a thriving and prosperous middle class.

Great series! It should be part of the education curriculum. I’m thinking seventh grade isn’t too soon.

Great tool for those who are compelled to “harp”…thanks!

Thanks RHT, just sent it to my grandkids.

yes and let us follow the money all the way to war and back.

ALso the names of the fascists who tried to use the Bonus Vets to physically overthrow the US Government and FDR.

Or Gen Smedely Butlers’s news reels and Book “War is a Racket”

Then they should move on to Samuel and Prescott Bush. Harriman Walker and Brown. The seizure of the bank for laundering nazi Money.

Also get into the names of the Large US and European companies that helped Hitler, Like Ford, IBM, ect ect ect

Then maybe how they really move money around in gov. The fake economic system. They markup and markdown printing money at will.

Then have them read declassified CIA docs and learn of how many times presidential candidates/presidents have preformed Treason and how the CIA creates false flags, stirs up war and is arming ISIS and AL Queida right now.

How about some real history not some prop up the fascists to fulfill a need to justify the lies people fell for.

Cities, states and the Feds have both a taxing problem and a $pending problem, yet they never seem to cut the s$ending but are always asking for more tax $$.

Oops! Bad fingers on the keyboard and didn’t spellcheck. Here’s what it should’ve said:

Cities, states and the Feds have both a taxing problem and a $pending problem, yet they never seem to cut the $pending but are always asking for more tax $$.

Either way the message is loud and clear…our legislators are spenders. They’re like ineffectual parents who can’t seem to be straight with their kids about what’s possible in the family budget. Credit card spending has made most Americans susceptible to the over spending monster. But when legislators can get elected AND award themselves once elected by promising their constituents the moon, they will do it. And when they are not held to account for the horrendous mismanagement of taxpayer funds…hey, it IS other people’s money…where’s the incentive to do the right thing?

The people have to be the nation’s conscience. Conservatives have tried and only gotten grief for their trouble. Still we soldier on.

The Economic spending is not like a budget and family checkbook. You do not even understand how it works.

So in your world the richest men in the world need tax cuts for what? The produce nothing here….

Now after we transfer more wealth to the 1% we need to tell those poor people who lost everything in the 2008 crash, and those who lost their jobs, they are useless freeloaders who need to die quickly because we will need more tax cuts for the 1% until they own everything and the people are enslaved into for profit jails.

But oh yea we always need more money for the war machine because we fight wars for what? We arm the enemy, the worst Shria Law country is given anything they want by the USA…the saudi’s

You fail to see the real world

You just cannot make this stuff up. Well, come to think of it, maybe you can if you’re broke and desperate.

California seeks to tax rocket launches, which are already taxed.

https://arstechnica.com/science/2017/05/california-may-have-found-a-creative-new-revenue-stream-taxing-rocket-launches/

Classic Bill Whittle for 2012—

https://www.youtube.com/watch?v=J9HzwA7Oi6M

Another plus. See the Midland International Airport on the map behind Bill? These guys have a unit based there—

http://commemorativeairforce.org/

California needs to stop paying federal taxes cause all we do is support the poor Red states